FCA Unveils Major Regulatory Changes for 2025 Authorisation

FCA Unveils Major Regulatory Changes for 2025 Authorisation

The FCA’s extensive questionnaire, originally due on June 30, 2025, was published on June 10, 2025. Since then, several regulatory changes have been implemented, including updates to consumer credit reporting and market conduct regulations.. Furthermore, understanding the FCA regulatory initiatives grid is essential for navigating these shifts. Recent regulatory changes in the financial services industry are reshaping authorisation standards, with particular implications for digital finance and crypto firms. Organisations must take proactive steps to align with these new requirements and ensure compliance moving forward

Why FCA is reshaping its regulatory framework for 2025

The Financial Conduct Authority (FCA) is undergoing a significant transformation of its regulatory framework in response to the Financial Services and Markets Act 2023. This legislation adds to the FCA’s objectives and regulatory principles, enhances accountability arrangements, and strengthens stakeholder engagement. Additionally, it grants powers to both the Treasury and financial services regulators to create a framework where expert and independent regulators have greater responsibility for setting requirements that apply to firms.

What are the FCA’s strategic goals for 2025?

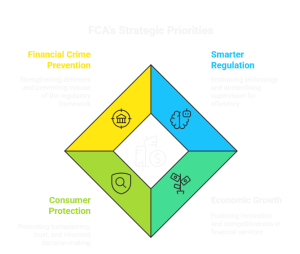

In March 2025, the FCA unveiled a five-year strategy focused on four core priorities: becoming a smarter regulator by embracing technology and streamlining supervision; supporting economic growth through innovation and competitiveness in UK financial services; protecting consumers by promoting transparency, trust, and informed decision-making; and tackling financial crime by strengthening defences and preventing misuse of the regulatory framework. This forward-looking strategy reflects the FCA’s commitment to building a more efficient, secure, and resilient financial system.